The Choosi Dollar Report 2016

Australians have a reputation for being laid back but it seems we aren’t taking a laissez faire approach to our hip pockets, with new research revealing the ability to be ‘money smart’ and meet financial obligations is not just seen as a great skill to possess, it’s actually seen as trendy.

These are some of the striking findings of The Choosi Dollar Report, the second study in a national series that investigates generational shifts, barriers and drivers of our financial and social behaviour.

Green is the New Black

Being able to repay your debts, setting and achieving savings goals, making astute investments – it might sound dry but the research reveals these qualities are becoming increasingly attractive to the average Australian.

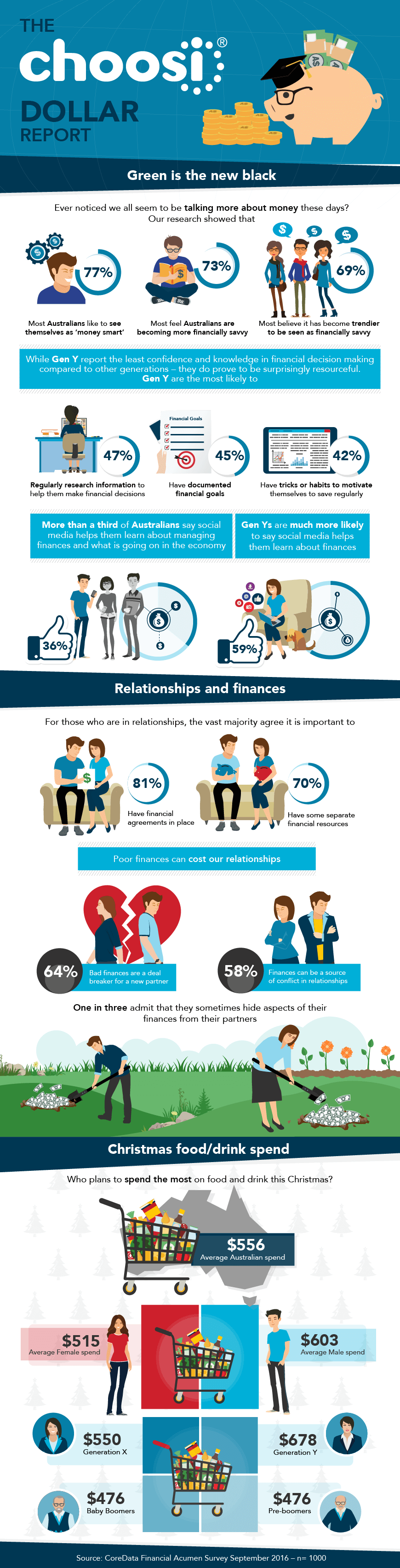

Not only is financial acumen a quality we like to see in ourselves, with 77% of respondents regarding themselves as financially savvy, it is one that we like to see in other people with almost 70% of those polled believing it is becoming trendier to be in control of our finances.

Furthermore, 73% of respondents believe that Australians are more financially savvy now than in the past, reflecting a nation that is increasingly wary about personal finance and the challenges of meeting financial obligations.

Money’s too tight to mention

There was a time when discussion of personal finances ranked alongside politics and religion in terms of appropriate dinner conversation but times are changing.

The study found that three in four Australians are comfortable discussing personal financial matters with others, while specific details about people’s earnings are to be avoided, conversation around savings hacks, where to find the best deal on a product or investment tips are all now seen as perfectly acceptable conversation topics.

In fact, almost 40 per cent of respondents reported they had been provided with helpful financial advice from friends.

And it’s not just face-to-face interactions with our friends that are increasing our collective financial smarts – social media is also playing a large role in helping educate Australians on money matters, with more than a third of respondents stating social media has helped increase their understanding of budget management.

Unsurprisingly, this number is much larger for the younger generation with almost two thirds of Gen Y respondents reporting to have gained a better understanding of finance and the economy via social media.

Walking the walk – converting knowledge to action

As outlined earlier, we have seen that Australians typically feel more educated when it comes to their finances than ever before. But, is this just a symptom of information overload? People who watch cooking programs are certainly more knowledgeable in this area than they would be otherwise, but are they attempting to knock up a flawless croquembouche the next night? The most likely answer seems to be ‘no’ in this instance.

A similar comparison could be made here. We might feel better about our understanding of interest rates and all factors fiscal, but are we putting that knowledge into practice? Again, the answer seems to be ‘no’ with 63% of respondents regarding themselves as ‘terrible’ or ‘average’ savers.

This isn’t necessarily because we aren’t all making an honest effort – a simple lack of income (58%) topped the reasons people cited for not meeting their savings goals and as we all know, increasing your income isn’t always possible.

Why money matters matter

Clearly, there is a gulf between intention and action and while Australians may feel they’re more knowledgeable than ever before when it comes to money matters, applying this knowledge is critical for ensuring financial security.

The great news is that reliable and realistic financial information is more accessible than ever before. Already proving they have the right mindset to navigate the challenges of personal finance, taking affirmative action and applying a bit of common ‘cents’ will see Aussies moving towards a brighter financial future.

Keep an eye out for our next instalment in the Choosi Research Series which we’ll be sharing with you soon.

14 Nov 2016