Retirement realities for Gen X

With financial pressure squeezing the “sandwich generation”, retirement looms in a cloud of uncertainty: so much, in fact, that experts wonder if it will arrive at all for Australia’s post-Baby Boomers. This article explains more.

When you finish up at work for good, how do you plan to survive? Retirees typically live off their pension, superannuation, life savings and the sale of assets. But for Generation X – born 1965–1980 – circumstances have called into question how, when, and if retirement will be possible.

Sandwiched between already-retired baby boomer parents who are living longer and generation Y/Z/Alpha children who are dependent longer ( a.k.a. The Sandwich Generation), Gen Xers are forging a path different to that of generations before them.

This paper looks at the retirement realities Gen X is facing, how we got here, and some tips for meeting your retirement goals.

Don’t you forget about me

Also known as the “MTV generation” who found their groove in the eighties and nineties, Xers have since shed the ‘Don’t worry be happy’, ‘I should be so lucky’ spontaneity of youth for big mortgages, kids, and working ‘9 to 5’. Today, older Gen X are in their early fifties while the youngest approach their mid-thirties. Research found that in 2011 4.65 million Australians (21 per cent of the population) made up Gen X6 and a significant portion had officially hit middle age.

There is a generation-wide issue facing Xers. Many of these future retirees may not have enough saved up in assets, in the bank and in super funds to finish working at 65 and retire – even with the pension – on the income they desire for as long as they can expect to live. Quality of life is on the line, and this gap in savings has huge consequences for households and government services.

Material world

When the Australian Government first provided the aged pension in 1909, 65 was deemed a suitable age to retire. Only half of men at this time (only males were entitled to a pension) made it to this age and their chance of living well beyond it was slim (11 years on average).

Today is a very different story. Average life expectancy in Australia is 83 years and 4 out of 5 of us live make it to age 709. Finishing work at the traditional age of 65 leaves twenty or more years of life relying on retirement savings and the pension.

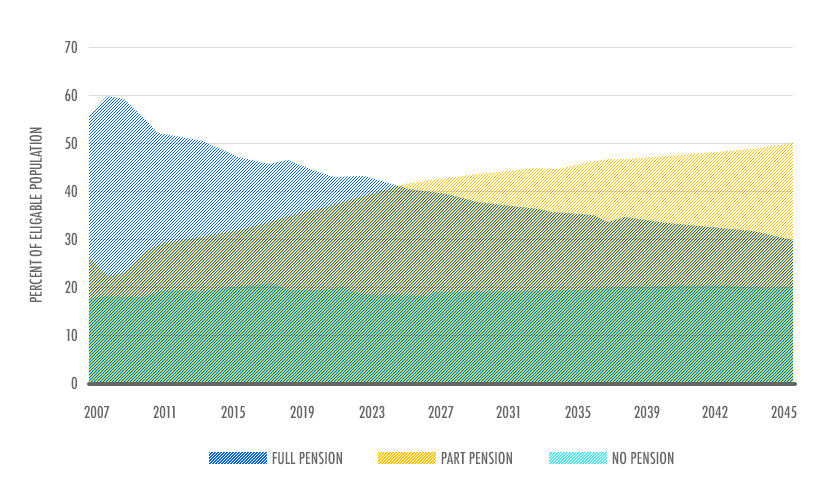

Until recently, Australians have placed significant reliance on the government pension as their retirement income. However, with foresight that national finances would struggle to support an increasingly ageing population, compulsory superannuation was brought into effect in 1992. Compulsory superannuation has now been in place for over twenty years. Gen X face very different retirement circumstances and are expected to rely more heavily on their super balances.

If I could turn back time

However, as a generation that’s living through the transition stage of superannuation, Generation X may miss out on the full benefits of the scheme. When compulsory super came into effect, it was anticipated that employees would contribute above the employer compulsory rate (3 per cent of wages in 1992; 9 per cent in 2003; 9.5 per cent now). Essentially, only 21 per cent of workers top up their funds and, worryingly, household debt has increased at the same amount as the growth in superannuation, a report prepared for CPA Australia found.

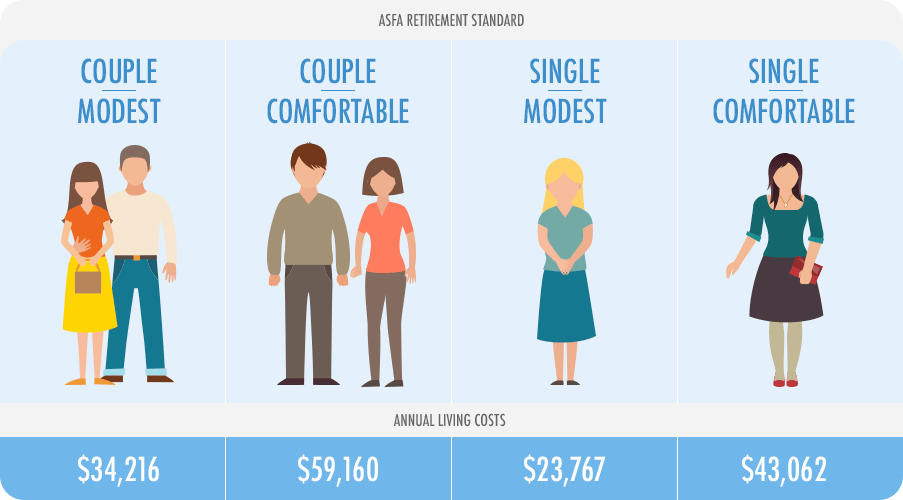

Based on retirement at age 65 in June Quarter, ASFA calculated the following household budgets:

This data assumes retirees own their home outright and are relatively healthy. Single calculations are based on female figures. A modest retirement is defined as more than the pension but covering only basic amenities; a comfortable retirement can afford, within reason, leisure activities and life’s luxuries (including a reasonable car and the occasional overseas holiday).

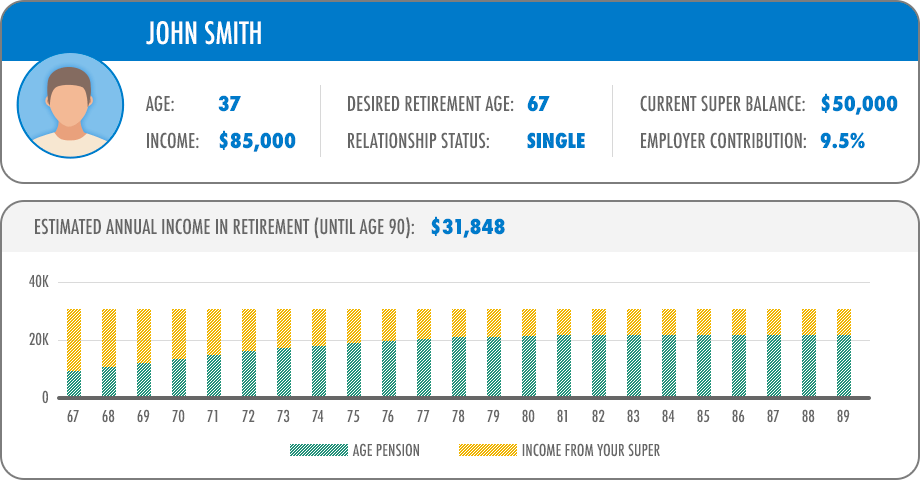

Compare the figures in the table to this example, calculated by Retirement Planner. A 37 year old single male on $85 K a year and a super balance of $50K would retire at age 67 with about $31K a year.

That figure falls short of the “comfortable” budget required for single retired life, and this is for a Gen Xer with another thirty years of working life ahead. If circumstances change – for example through job loss, debt, illness or injury – retirement planning could go out of the window. For older people in Gen X (already in their fifties), there is only another 17 or so years of work to top up the super fund before age 67.

Don’t stop ’til you get enough

The ideal amount for retirement will depend on your needs and your wants. The necessary amount will depend on your life expectancy, medical/care fees as health deteriorates in old age, debt, and expectations around inflation.

You may also have retirement goals with your partner for specific things like travelling or living overseas, buying your dream car, a golf club membership, or helping your children with their milestones (like weddings).

Never gonna give you up

To compensate for this gap, it seems that Gen X are intending to work longer than their parents. One in five workers in the age bracket 45–49 now intends to work beyond their 70th birthday (and the will-be retirement age of 67). In 2004–05, just 5 per cent of people at this age said they would work past 70. In the most recent survey, an additional 20 per cent of people over 45 said they did not know when or if they would retire at all.

40 per cent of Australian men and 35 per cent of Australian women say they won’t retire until they’re financially secure, while others want to stay employed simply because they can (health- and ability-wise). In 2014–15, 185,400 people over the age of 45 had decided they would return to the labour force: 43 per cent of these said that they motivated by “financial need”.

Age of reason

While the realities of retirement are somewhat uncertain for Generation X, there’s still time for smart action to help make retirement goals possible. By doing the maths on retirement, spending, saving and super contributions can be adjusted before it’s too late. With your retirement budget in mind, you can re-evaluate current investments and make longer term plans to see you through retirement.

When planning in these golden years for how you will fund your retirement, another consideration is how you would cope if all didn’t go to plan and you were injured and kept away from work, for example. A holistic approach to planning should get you the best results.

22 Mar 2017